Market analysis

Oftentimes, teams that complete the pre-seed stage (the idea stage during which startups raise funding – Ed.), build their MVP (minimum viable product – Ed.), validate their hypotheses, and go through pre-acceleration and acceleration programs are faced with the challenge of staying afloat without the support of mentors and experts and that’s when things start to fall apart. For many, life after MVP is a nightmare come true.

To assess your startup’s growth prospects, you must constantly analyze the market and keep track of the segments and value offers you’ll encounter. For startup founders, this is an opportunity to solve the issue of market positioning and increase their average revenue. For investment funds, it is a way to gauge the startup’s prospects – such as how quickly it could grow or which adjacent markets it could move into.

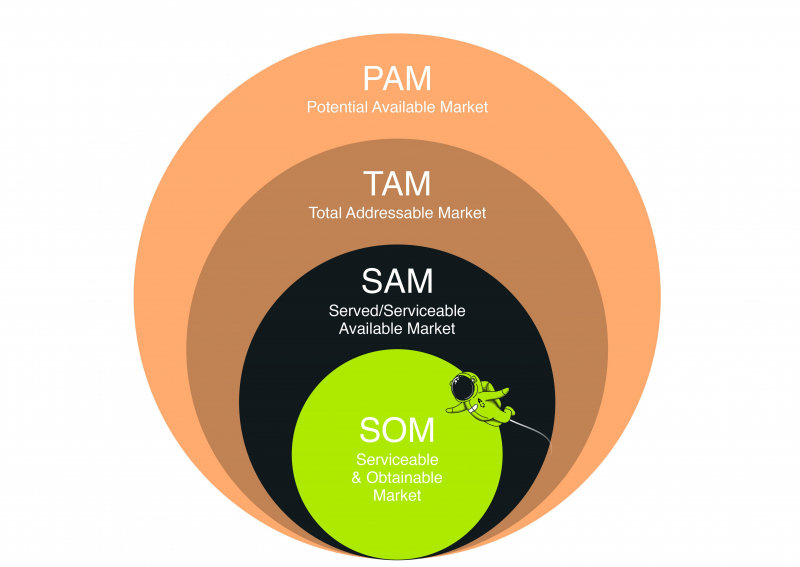

There are four key concepts here:

PAM (Potential Available Market) – a global concept that is viewed outside of geographical borders and reviews the overall state of affairs on the planet and a market’s development based on global trends.

TAM (Total Addressable Market) – how many customers and which share of the target market are interested in products and services of the same category as yours. Presents targets for two-to-three years.

SAM (Served/Serviceable Available Market) — this is the maximum possible market size for your company’s products and services. This is a yearly target and one you should strive towards with your medium-term strategy.

SOM (Serviceable & Obtainable Market) — this is the part of SAM that your business can actually “take over” considering its development plans, as well as the expected changes among the competition.

Startups in the pre-seed and seed stages have a hard time imagining their company reaching a value in billions. But that is indeed the target they should always have in mind – and which they can reach in five or seven years. The basic principle you should follow is this: the potential market is always bigger than the target market.

HADI cycles and why products fail

Post-acceleration, startups often face the issue of no longer growing once they’ve entered the free market. They fail to expand into new market segments and eventually even the sales they’ve already had start to decrease. The main reason why startups fail is that the market doesn’t need their product. A simple, but effective practice can help you avoid his problem: HADI cycles. They consist of four stages: Hypothesis, Action (testing the hypothesis), Data (acquiring information), and Insight (making conclusions based on the action’s success or lack thereof).

HADI cycles must be done regularly on a one- or two-week basis. One week is enough for B2C, where you can quickly measure an action’s efficiency through marketing methods. As for B2B, the testing period should last between two weeks and a month. HADI cycles work well with traction maps, which are a tool that’ll help you change the scale of your testing. The first stage of a traction map is the first sale. A single sale is needed to understand the level of one’s value offer. At this stage, the product may and should undergo significant changes; the economic and business models should change, too.

Once you’ve got systematic sales, that’s when you know you’ve found a niche and can start thinking about scaling up your product. There is a misconception that, if you’ve made a few sales and are convinced of the product’s quality and the demand for it, you can just hire a sales team and start making millions. In fact, you must constantly test new audiences, check for sub-groups that weren’t taken into account at the beginning, study their interests, and analyze their consumption models.

The value offer

One big issue startups have is that they make sales without putting value on the product. If there's no value, you’re stuck in a perpetual “pushing” mode – through trial runs, discounts, newsletters, and so on. This way, you’re not increasing your audience, not making your customers happy, and not expanding your community. If there is value, customers come back; otherwise, you only get single-instance purchases without establishing habits. Once value appears, sales should happen by themselves, naturally growing through word of mouth. With B2B, it is even more difficult, as further sales will only take place through partners.

So answer these questions: who are your customers, what issue are you helping them solve, which benefits do you provide, what makes you better than your competitors, and how do you back your words up? These questions should help better approach your business model and tailor it for sales. It is necessary to pay attention to your advantages and know whether they are still beneficial to the customers.

Looking for value

There are several stages you must complete when finding your value. The first is the discovery stage (pre-seed and seed levels), during which you find your target audience and outline your value. The second is validation. After the second stage, a startup becomes a “grown-up” venture enterprise which only needs funding for further growth or for expanding into new markets.

Product offerings often revolve around a single definition. But products can be positioned differently for different audiences. This way, you boost your brand awareness and brand touchpoint metrics. If you still don’t have a clear image of your client, hypothesise who your target audience would be and what value you’re offering; then, confirm it via custdev (testing of ideas or prototypes via potential customers – Ed.). If sales still aren’t growing, you’ll need to make up for lack of market expertise by working with experts knowledgeable in the relevant market segment.

If you do have clients, but they are few, use ABCDX segmentation. It is a fairly simple method that will help you quickly understand your audience.

A – the product is in very high demand, therefore purchased quickly, often, and at a high price

B – the product is in demand, but there are criticisms and calls for integration, customization, or modules; the average sales cycle is longer than one month, but less than three

C – there is demand for the product, but the value isn’t high, thus customers are willing to pay little and have a number of significant criticisms

D – customers ask lots of questions, but don’t buy anything

X – the most valuable client who is ready to pay a lot and often, but needs a special product that you don’t have, but have the ability to make.

Product strategy and sales models

Sales models and strategies are very different for B2C and B2B products. With B2C, you must rely on marketing to make the brand recognizable. PR and advertising must be focused on the product’s perception and the emotions it evokes.

Use the classic AIDA model:

Attention – things to gain your customers’ attention: captivating message, viral videos, pictures, text.

Interest – ways to interest customers in your product: pricing, unique features, ease of use.

Desire – what makes people want to buy the product: promotional campaigns, celebrity endorsements, reviews by bloggers.

Action – things that motivate customers to purchase the product: shortages, limited offers, flash sales.

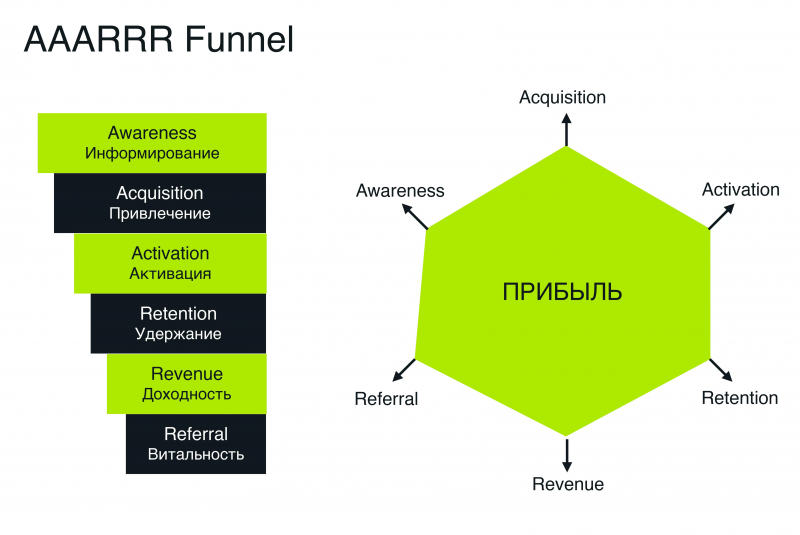

A more complex model is the AAARRR Funnel, which stands for Awareness, Acquisition, Activation, Retention, Referral, and Revenue. Of these metrics, retention is the most important and is what measures a company’s performance.

With B2B, the strategy is different. Here, sales are more important than marketing and promotion is done mostly through direct sales and event, direct, and content marketing. It’s important to establish personal relationships with clients, support them, consult them, and host workshops on new versions and features. The SPIN sales model, which consists of four questioning stages, is especially appropriate for B2B sales. Situational questions help establish contact and acquire general data about a business and its specifics. Problem-based questions uncover the difficulties and complications faced by a business, as well as its hidden needs that could be developed further. Implication questions aim to reveal to the customer the magnitude of their troubles. Finally, need-payoff questions make the customer realize the importance of your product and how it could solve their issue.

Managing your clients

Businesses in Russia have one common issue: they want to increase their sales and customer base, but not to support their existing clients. They forget that sales aren’t just about finding leads, working them, closing, and getting money. It’s also about managing clients, supporting them, increasing the average revenue, identifying new needs, and more. Why is that so? Because these companies don’t have account managers. At first glance, they seemingly don’t bring in much revenue and don’t make huge deals. But account managers make sales, develop customers, and foster brand loyalty.

Andrey Popov is the investment director for the private venture fund TC Logiciel (Lausanne), the head of Rocket Founders venture agency , a “tracker” for the Internet Initiatives Development Fund (IIDF) and the Russian Venture Company (RVC), founder of the QuantumGrowth agency, and founder of Rocket University.