English language teacher

E-Residency Around the Corner

Entrepreneurship has almost never been easier, thanks to the ease of Estonia’s e-Residency program. In December 2014, the small Baltic nation developed a new virtual system that facilitates the start-up process for non-Estonians. Now, people from around the world are able to enjoy access to Estonian services such as company formation and registration, banking, payment processing, and taxation. The benefits of such a program can’t be overstated, because in today’s world of Digital Nomads, Estonia’s e-residency is capable of providing people, such as software developers and writers, with complete location independence, access to the European Union single marketplace, and a highly competitive tax rate.

For those unfamiliar with all that Estonia does, it’s at the forefront of the government transition to e-services. One such prominent example is its presidential elections. Estonian citizens all receive a unique digital signature known only to them, and using that signature, they can cast their vote for the candidate of their choice from wherever they are. Just imagine — no longer do you need to stand in long queues to vote at polling stations located in inconvenient locations. Who knows? Countries like the United States that suffer from underwhelming voter turnout may see an uptick in participation.

In the interest of full disclosure, I myself am an e-Resident of Estonia as of earlier this year. I did so primarily because I’m enrolling into a Master’s program in Digital Education Technology at the University of Tartu, as well as another Master’s program that’s co-hosted by Tallinn University on Interactive Design. Considering that’s two university programs at two Estonian universities, it seemed advisable to register for the e-residency.

In addition to my future university studies, I also started my own company, ArcInset OU, which specializes in publishing, translation, and software development. By doing so, I’ve become quite familiar with the entire system and the way it works, from registration and government paperwork to banking and taxation. The designation OU, if you’re wondering, is the Estonian designation for their equivalent of an American LLC or Russian OOO.

The entire process is nowhere near as difficult as it may sound, but this is mostly in part due to how the system’s been streamlined. For a complete description, you can check out the Estonian government’s e-residency page, but I’ll give you a general run-through of what I experienced. Now here’s a disclaimer: becoming an e-resident of Estonia does not grant you the ability to live and work in Estonia. For that, you need to file for a visa that allows you to be in the country. The e-residency only permits usage of Estonia’s e-system in an effort to maintain transparency.

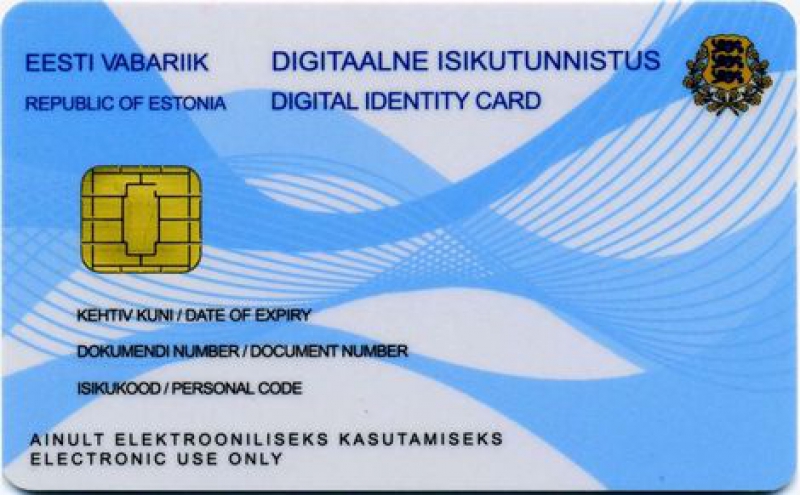

The initial steps are possibly the simplest. First, go to the e-residency's website and click to apply. For this, all you need is your passport/ID, a passport-style photo, a statement of motivation, and your credit card to pay the state fee of 100 euros. After uploading these documents, answering some questions, providing some links to social media accounts, and paying the fee, your application is ready for submission. It’ll take about a month or two for the Estonian Police and Border Guard to conduct a background check and approve your application. Once they do so, they’ll send a message that your e-residency kit, which includes your SmartID and SmartCard reader, is ready for pick-up. The cool thing is you don’t need to visit Estonia to get your kit as you can indicate your preferred location anywhere. For me, I picked up my kit in Estonia’s consulate in St. Petersburg.

One important step that is required is the need to hire a business service provider (BSP). This is really only necessary if you don’t plan on living in Estonia (granted, it’s an awesome country to visit) as the BSP provides you with a physical business address capable of receiving mail. If you’re wondering why this step is important, Estonian law requires that Estonian companies have a domestic address, which is why your BSP is your best friend, assuming you don’t actually have an Estonian best friend who can loan you an address. On top of the address, they supply additional services like tax consultations, banking application assistance, and accounting services. In my case, I hired the services of LeapIN and I’m quite satisfied with the service I’ve received so far. LeapIN went so far as to help me open my LHV bank account and file for my VAT number ("Value-Added Tax").

As for how you can receive the money you want to earn, there are currently two methods: TransferWise or LHV Bank. Since the application to LHV requires a little bit of time for verification and approval (about two weeks for me, which included filling out a special US tax form applicable only to US citizens), if you want to start earning money right away, then TransferWise is the way to go. It supports all the major currencies you need, although at the moment users are not able to load Russian rubles their account, but they can upload dollars, euros, or pounds and then convert to rubles. In other words, a person can send rubles, but they can’t load rubles. Then at the end of every month, you should download the bank statements of your TransferWise accounts and upload them to your BSP.

If you’re able to wait a little bit before earning money, then I’d recommend waiting until your LHV account opens. A couple benefits exist here in that LHV offers an option where your Estonian company can complete financial transfers to other European accounts in euros for free. No transaction charge at all. Secondly, LHV automatically sends your bank statements to your BSP, so no need for you to download files like with TransferWise. The drawback however is that to open your LHV account, you need to actually visit the main branch in Tallinn to physically sign the paperwork, a step that requires roughly only 30 minutes.

Now the most important part for the entrepreneurs in the world reading this post — taxation. To be straight-forward, as an American citizen, I’m over the roof about the simplicity of the tax system. However, it takes a little getting used to at first just because it’s a new system, but fortunately, your BSP is there every step of the way (hey, it’s what you’re paying them for, right?). Moreover, the Estonian Tax and Customs Board is always available for consultation, and they’ll respond to your email within a week (in my case, it never took more than three days). The best part? They answer your everyday business questions in Estonian, Russian, and English for free, which might explain the relative lack of Google results for business tax consultants. So armed with your BSP and the Estonian government, you’ll avoid all tax troubles so long as you remain transparent.

One last point to make. Let’s assume for a second that you want to translate and proofread some very important text or mobile application from English to Russian or vice versa. You contract some independent freelancers to complete this task for you, and they do so. They technically don’t count as employees, but you need to pay them for their services. Using either LHV’s or your BSP’s accounting software, your contractors are able to issue you an invoice, which you’re able to then pay using your bank account. The same works vice versa if somebody hires your company for some project. Once you finish the work, you issue an invoice, sort of like a service contract. Just be sure to ask the Estonian tax board about tax liability so that you don’t get into any trouble.

In the future, I’ll continue learning about some of the more nuanced aspects, such as hiring an actual full-time or part-time employee, but for the present moment, this is all you need to know to launch your own start-up experience.