Do a test run

What if I told you that just one trick can easily cut your spending by 10-20% right off the top? Just write down everything you spend and earn for a whole month. Today, when we're all going cash-free, it's getting hard to be mindful of how much money you're spending. So, it’s time to be honest with yourself, no cheating. Treated yourself with some takeout on the weekend? Noted. Renewed your Spotify subscription? Noted, too.

Pick the right tools

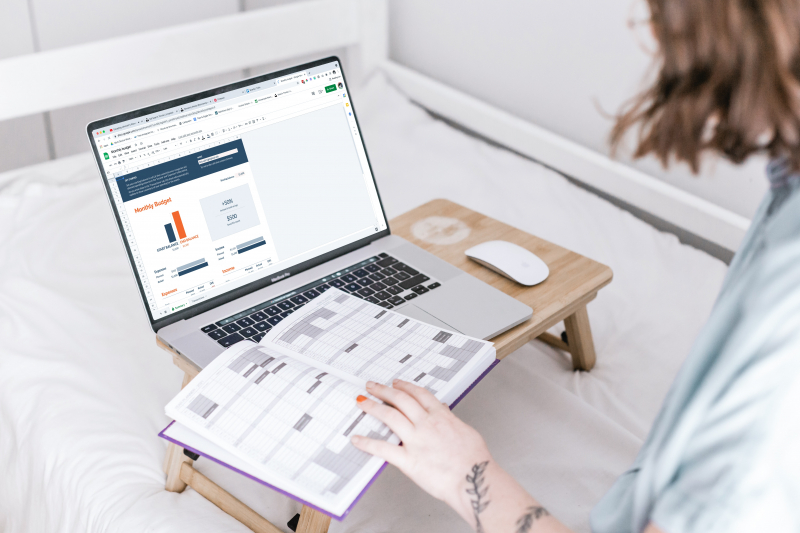

Go for what suits you better, be that writing by hand or using digital tools. Here are some options:

- Notes and paper planners

This is a good starting point for becoming more conscious of your money habits. By writing down all of your income and expenses by hand, you can thoroughly analyze the results and properly reflex on any questions. Plus, you have all the freedom for creativity. This approach might require more time and effort but you won't need any additional tools; plus, it will give you a good baseline of your spending.

- Excel spreadsheets

This is a more automated option that'll suit spreadsheet fans: all you have to do is create a template with the necessary cells and categories and set it up to calculate everything automatically. It's great to have all your data in one place and in a structured form.

- Apps (bank apps and trackers)

At your disposal is a wide range of apps with multiple must-have functions: cross-device sync, budgeting by days/weeks/months, goal-setting, statistics, analytics, etc. These are your bank apps (Bank Saint Petersburg, Tinkoff, or Sberbank) with cool features but they won't be enough if you have several cards from different banks. There are also money trackers, such as CoinKeeper, Money Flow, Spendee, or Wallet. But of course, there are even more options, so try a couple of different ones and pick the one you liked most.

Analyze your spending and find ways to save

Credit: Sincerely Media (@sincerelymedia) via Unsplash

By the end of this experiment, give your life a good once-over and try to organize the numbers by categories, such as salary, rent, groceries, transport, and eating out, and calculate total sums for each of them. It will help you see the whole picture. Do your expenses measure up to your income or not? What categories are overspent? What are the nonessential things you keep buying?

From time to time, we may experience financial struggles, which sometimes have nothing to do with us but some life circumstances. But we should always hold our heads high and search for ways out. Luckily, there are plenty of ways to do so, and we promise, it won’t hurt to try: perhaps you can set limits for categories you want to cut ties with, or pack your food instead of eating out, or maybe you don't need coffee every day and so many subscriptions. And always remember to sleep on any out-of-budget purchase before buying it. You’ll be surprised when you see how such tiny changes may bring excellent results.

Saving goals, emergency funds, and investing

While living within your limits may be okay, we want to strive, and one of the best ways to save money is to set a goal. Start by thinking of what you might want to save for – perhaps you’re saving for a new phone, planning a vacation, or want a little extra in your bank account for a rainy day. Then, figure out how much money you’ll need and how long it might take you to save it.

Short-term goals: emergency fund (a few months of living expenses, just in case), vacation, or buying a new device for yourself.

Start off with a small achievable goal for something fun and big enough, then, when you’ll reach this goal – and enjoy the fun reward you’ve saved for – it will give you a boost that makes the payoff of saving more immediate and reinforces the habit.

Long-term goals: buying your own apartment or home, education, etc.

If you’re saving for something in the far future, consider putting that money into an investment account – but don’t forget to do your research, as investments come with risks.

Make saving your habit

Review your budget and check your progress every month: not only will this help you stick to your personal savings plan, but it also helps you identify and fix any problems along your way. That’s how you master budgeting 101!

Exploring the new is always a good thing, so don’t forget to check out our recent stories on networking and efficient studying, as well as many others.